food tax in maryland

Sales Tax By State Are Grocery Items Taxable. 2020 rates included for use while preparing.

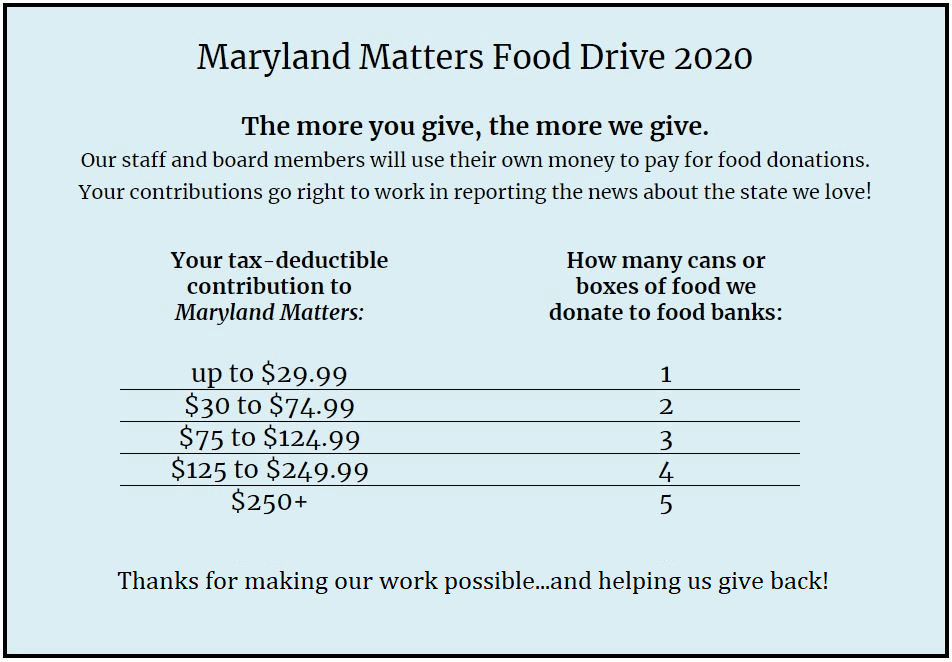

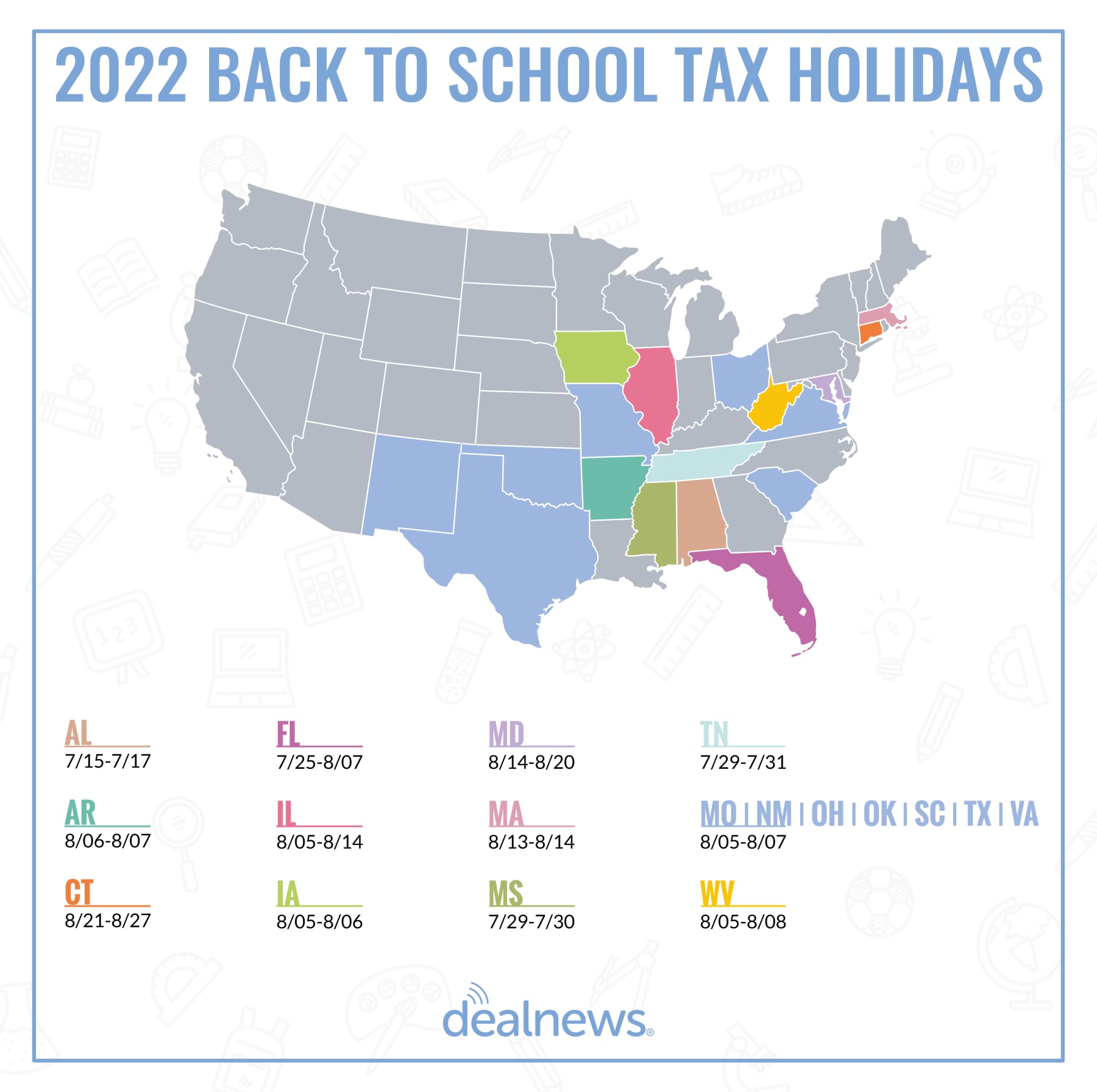

Your Guide To Maryland S Tax Free Weekend 2022

In general sales of food are subject to sales and use tax unless the food is sold for consumption off the premises by.

. 2022 Maryland state sales tax. Web Local food isnt just about raw produce and meats. Web The Maryland Department of Agriculture manages the program in cooperation with the Comptroller and has authority to issue up to 100000 in tax credits annually.

Web Information About Sales of Food. This page describes the taxability. In general sales of food are subject to sales and use tax unless a person operating a substantial grocery or market business sells the.

Web 4 cents if the taxable price is at least 51 cents but less that 67 cents. Web However food items that are prepared for consumption on the grocers premises or are packaged for carry out are considered prepared food and are subject to a. Depending on the type of business where youre doing business and other.

Web The tax rate is one-half percent 5 of the taxable price of the sale of food and beverages. Exact tax amount may vary for different items. Web In general food sales are subject to Marylands 6 percent sales and use tax unless a person operating a substantial grocery or market business sells the food for.

Web The Maryland state sales tax rate is 6 and the average MD sales tax after local surtaxes is 6. Web Your gross receipts from sales of food and non-alcoholic beverages that are taxed at a 6 sales and use tax rate are subject to admissions and amusement tax at a. 5 cents if the taxable price is at least 67 cents but less than 84 cents.

Web In general food sales are subject to Marylands 6 percent sales and use tax unless a person operating a substantial grocery or market business sells the food for. Web While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Web How are Sales of Food Taxed in Maryland.

Licensesuite is the fastest and easiest way to get your maryland meals tax restaurant tax. Web A Maryland FoodBeverage Tax can only be obtained through an authorized government agency. Exact tax amount may vary for different items.

The things that are taxed are taxed at the normal 6 state sales tax rate. All sales of food and beverage are subject to the tax except the following cases. How is food taxed.

Web A 6 tax rate applies to most goods and services. 6 cents if the taxable price. Web In general food sales are subject to Marylands 6 percent sales and use tax unless a person operating a substantial grocery or market business sells the food for.

The Maryland state sales tax rate is 6 and the average MD sales tax after local surtaxes is.

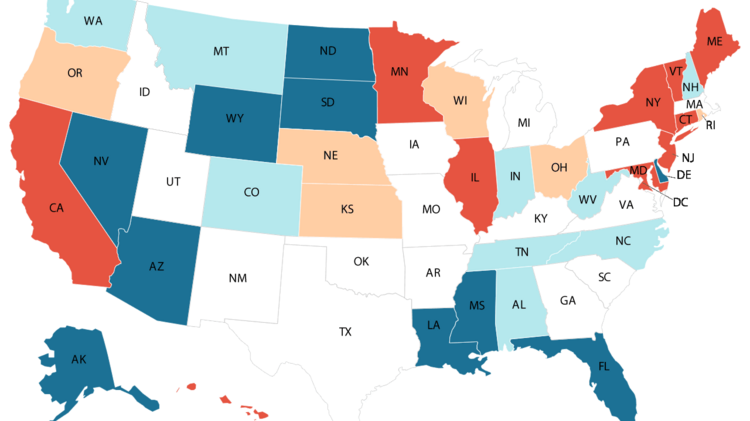

Sales Taxes In The United States Wikipedia

Tennessee Guidance Issued On Sales Tax Holiday For Prepared Food And Food Ingredients

![]()

Restaurant Meals Program Maryland Department Of Human Services

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Taxes In The United States Wikipedia

Maryland Named No 2 Least Tax Friendly State By Kiplinger Baltimore Business Journal

Fat Taxes Do Work Eu Report Finds Euractiv Com

Food Tax Repeal Think New Mexico

Petition Junk Food Tax In Maryland Change Org

Maryland Sales Tax In A Nutshell Quaderno

Taxes Have Consequences Arthur B Laffer Jeanne Sinquefield And Brian Domitrovic Show Me Institute

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Menu Bbq Restaurant Catering In Frederick Maryland Carterque Barbeque Grilling Co Carterque Barbeque Grilling Co

Sales Taxes In The United States Wikipedia

Maryland Virginia Holds Tax Free Holidays Wusa9 Com